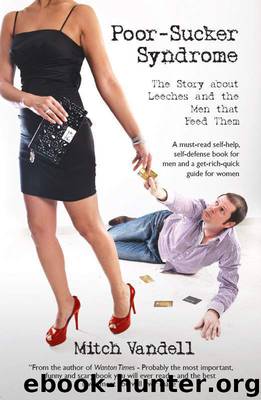

Poor-Sucker Syndrome: The Story about Leeches and the Men that Feed Them: A self-help, self-defense book to save men. And a get-rich-quick guide for women. by Vandell Mitch

Author:Vandell, Mitch [Vandell, Mitch]

Language: eng

Format: epub

Publisher: Booksurge

Published: 2012-04-04T16:00:00+00:00

The graph shows how a Poor-Sucker is ever more unlikely to reverse a trend of being financially abused the more money he allows himself to spend on a leech and the longer he stays in the relationship.

9.2 The Stop-Loss

The strategy known as “Stop-Loss” is from the science of behavioral finance, which comes from psychology. Behavioral finance is aimed at explaining the behavior of individuals acting in financial markets. In doing so, many investment strategies have been developed to counter the cognitive biases that inhibit our ability to make rational decisions. Interestingly, these same strategies developed for traders on the stock market can be directly applied to men wanting to stop the Poor-Sucker Syndrome in its tracks from developing. The behavioral mechanisms that motivate us to throw good money after bad and to irrationally justify a relationship that is completely bankrupting us are largely the same. We humans hate to admit being wrong—even to ourselves! We develop emotional bonds with the past choices we made, which can lead us to justify mistakes we made, even if staying the course will unquestionably lead to catastrophic consequences. We are often inhibited in making balanced decisions simply because of our invested emotions.

Two of the most typical of biases found in behavioral finance include the interrelated concepts of the previously described “sunk costs” and “anchoring.” “Anchoring” is the tendency to attach or “anchor” to a reference point on which we base our decisions. The problem is exacerbated when there is no logical relevance to this anchor. Our judgment becomes emotional and illusory. An obvious example is the unwillingness to sell a stock at a loss, even when we believe its upward potential is limited, compared to other stocks on the market. We wait to sell at the price we paid, even if it takes years !

The Stop-Loss syndrome is probably the most common and most known trading strategy used to counter the negative impact that biases can have on our decisions. The trader sets pre-defined parameters for his future actions, thereby effectively eliminating emotional biases to achieve Stop-Loss.

A Stop-Loss action is most simply described as an automatic sell order of a stock that is triggered when its price falls below a certain threshold. The idea is that by determining beforehand the largest loss you are willing to take on a stock, you thereby bypass the risk of refusing to sell it when it starts to nose-dive in price. That is, you won’t need to overcome having to accept a sunk-cost to make a sell decision.

Applying the Stop-Loss to Counter the Syndrome

To avoid becoming a Poor-Sucker, it is a good idea to apply a Stop-Loss when entering a romantic relationship with a woman. In practice, this involves a two-step approach:

Setting a stop-loss limit: to be done at the earliest stages of meeting and dating a girl. How much is the maximum amount of money you are willing to spend on this girl? How to calculate the limit is described below.

Separate credit card: a separate credit card on which you adjust the credit limit when entering into a new relationship.

Download

This site does not store any files on its server. We only index and link to content provided by other sites. Please contact the content providers to delete copyright contents if any and email us, we'll remove relevant links or contents immediately.

Still Foolin’ ’Em by Billy Crystal(36341)

Spell It Out by David Crystal(36106)

The Great Music City by Andrea Baker(31908)

Professional Troublemaker by Luvvie Ajayi Jones(29644)

Trainspotting by Irvine Welsh(21630)

Call Me by Your Name by André Aciman(20481)

We're Going to Need More Wine by Gabrielle Union(19028)

The Secret History by Donna Tartt(19016)

Cat's cradle by Kurt Vonnegut(15320)

Ready Player One by Cline Ernest(14627)

Molly's Game by Molly Bloom(14129)

Bombshells: Glamour Girls of a Lifetime by Sullivan Steve(14045)

The Goal (Off-Campus #4) by Elle Kennedy(13645)

Leonardo da Vinci by Walter Isaacson(13302)

4 3 2 1: A Novel by Paul Auster(12362)

The Social Justice Warrior Handbook by Lisa De Pasquale(12179)

The Break by Marian Keyes(9357)

Crazy Rich Asians by Kevin Kwan(9268)

The remains of the day by Kazuo Ishiguro(8961)